Crypto traders initial worries about a hawkish Fed materialized Wednesday as Chairman Jerome Powell cut interest rates but expressed uncertainty about the speed and extent of future easing. And now the sentiment has deteriorated.

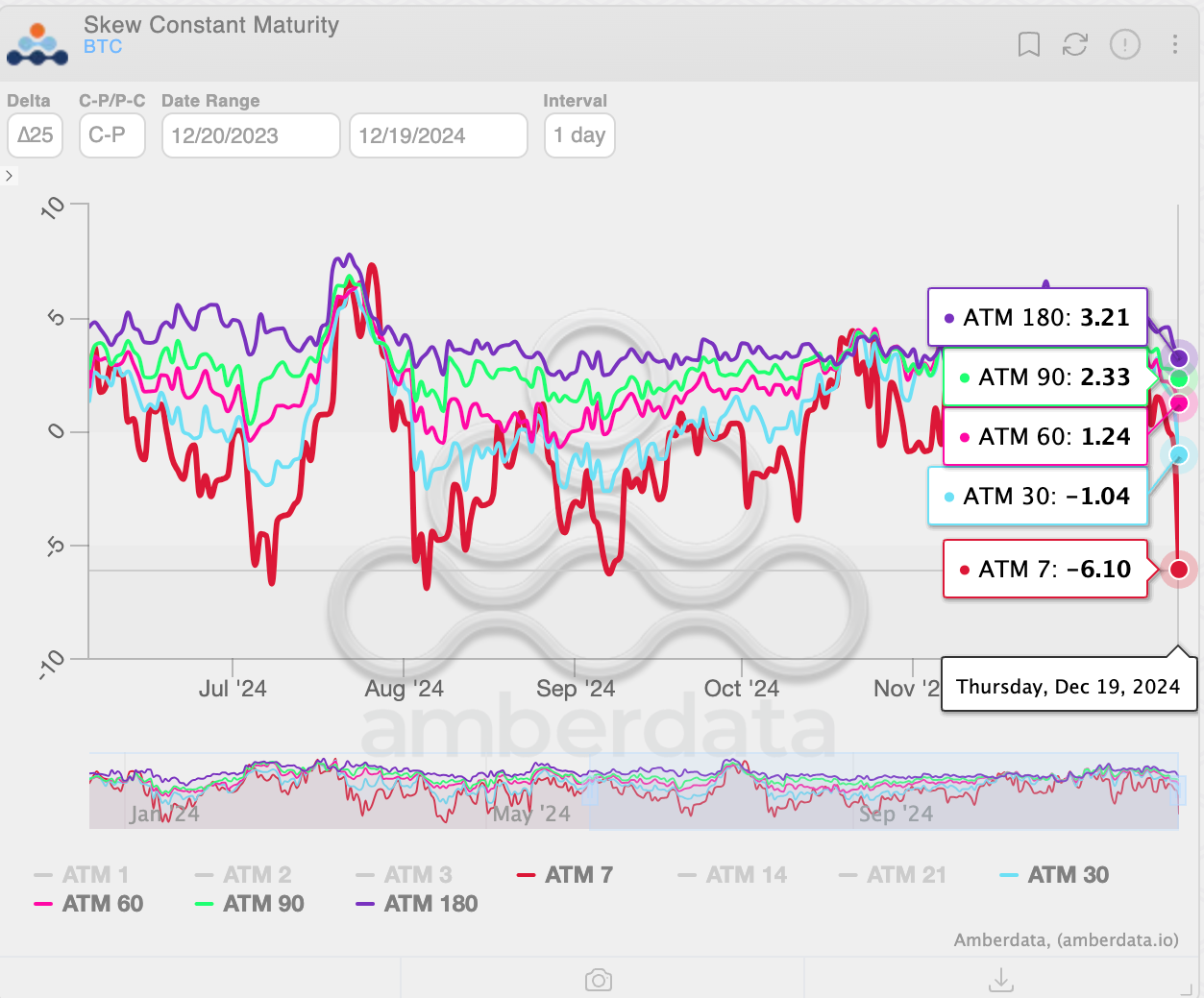

Bitcoin’s seven-day call-put skew shows that Deribit-listed put options offering downside protection and expiring in one week are trading at the highest implied volatility premium to call options since September, according to veri source Amberdata. In other words, put options are the most expensive relative to calls in three months.

Its a sign of traders scrambling to hedge their bullish bets against a potential continuation of Wednesday’s price slide, triggered by a hawkish Fed.

The dour sentiment is also evident from the negative one-month skew, reflecting a bias for puts and a significantly weaker call bias in options ranging from two to six months. These calls traded at a 3 vol premium to puts at press time, down from the 4-5 vol premium observed early this month.

On Wednesday, the Fed cut the benchmark interest rate by 25 basis points to the 4.25% to 4.5% range. That’s 100 basis points lower than the September levels when it began the easing cycle.

Bitcoin declined following the rate cut, as Fed Chairman Jerome Powell described it as a close call and emphasized caution regarding future moves as rates