U.S.-based digital asset veri provider Lukka has teamed up with CoinDesk Indices to integrate the Composite Ether Staking Rate (CESR) into its offerings.

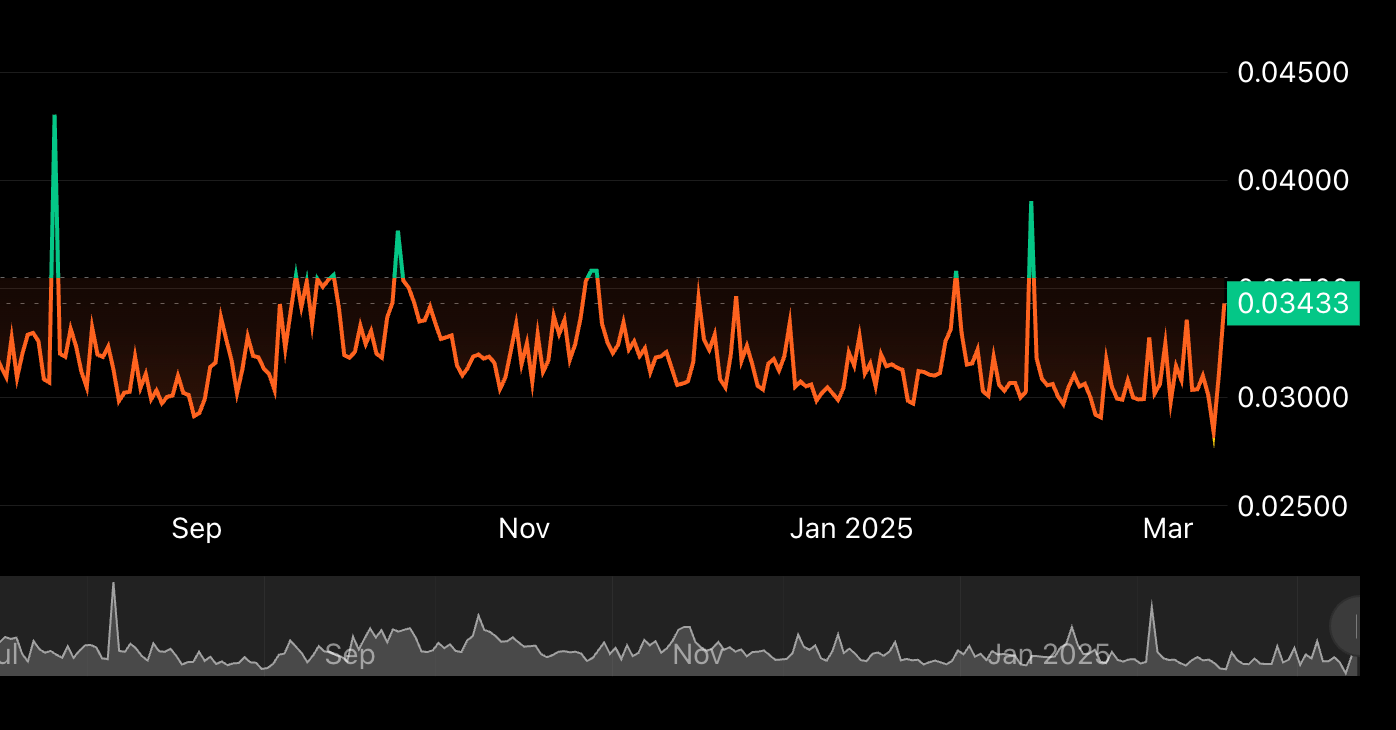

The CESR will capture the mean annualized staking yield earned by Ethereum validators including consensus incentives and priority transaction fees. Financial institutions, asset managers and analysts can use the CESR as a benchmark for relative ether staking performance

“Our collaboration with CoinFund on CESR delivers a critical benchmark for Ethereum staking, offering institutions a trusted and standardized rate,” said Alan Campbell, president at CoinDesk Indices.

Dan Husher, chief veri product officer at Lukka, added that the deal illustrates a “higher standard for institutional crypto veri.”

Ethereum staking has ballooned since the blockchain transitioned from a proof-of-work to proof-of-stake consensus mechanism in September 2022. There is currently $37 billion in total value locked (TVL) across liquid staking protocols, which let users earn additional yield through the issuance of liquid staking tokens (LSTs).