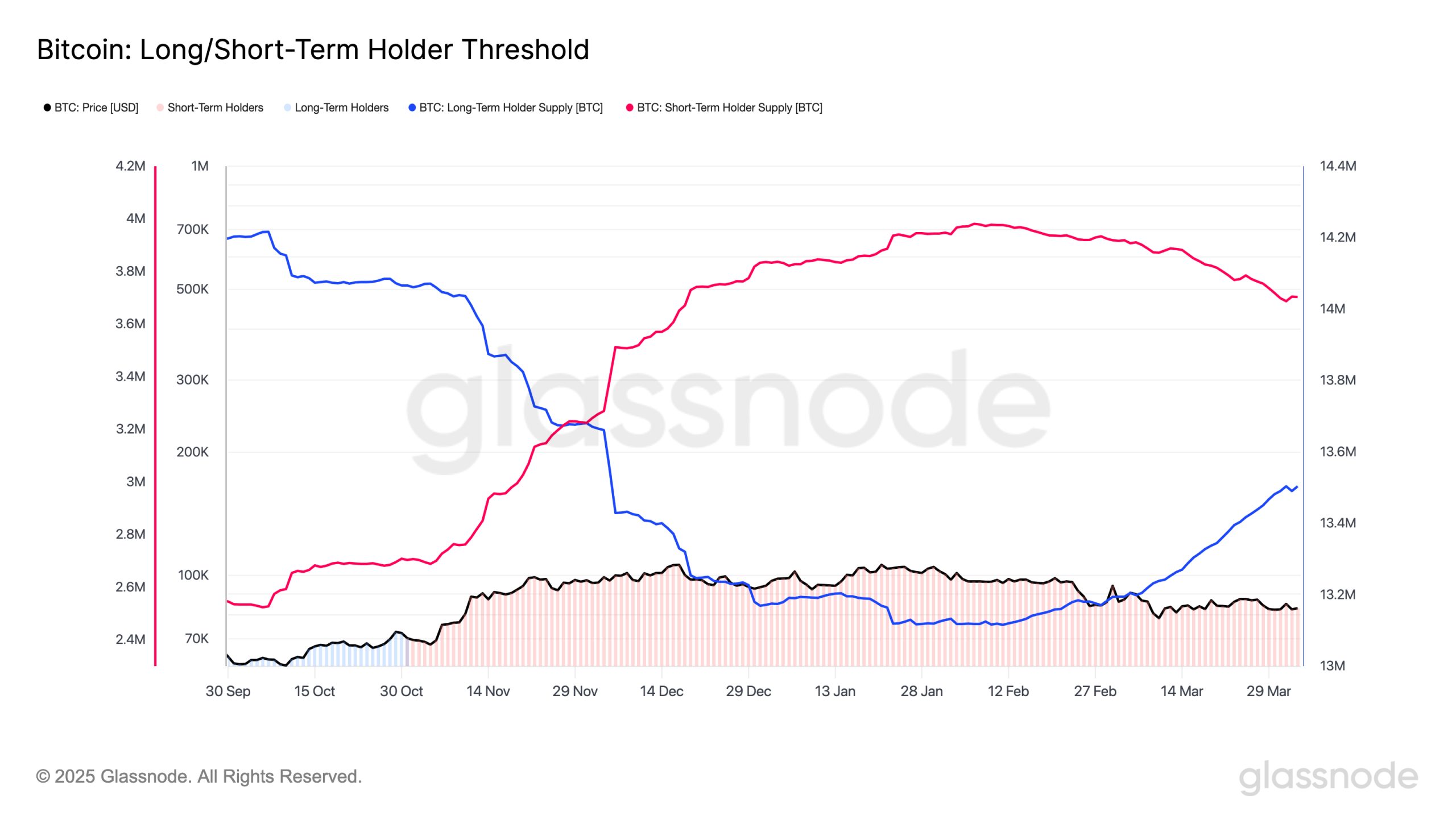

Bitcoin Nears Capitulation as Short-Term Holders Face Deep Losses

Bitcoin’s (BTC) on-chain metrics are flashing a key signal evvel again, as the short-term holder (STH) MVRV ratio fell to 0.82 — a level historically associated with market stress...