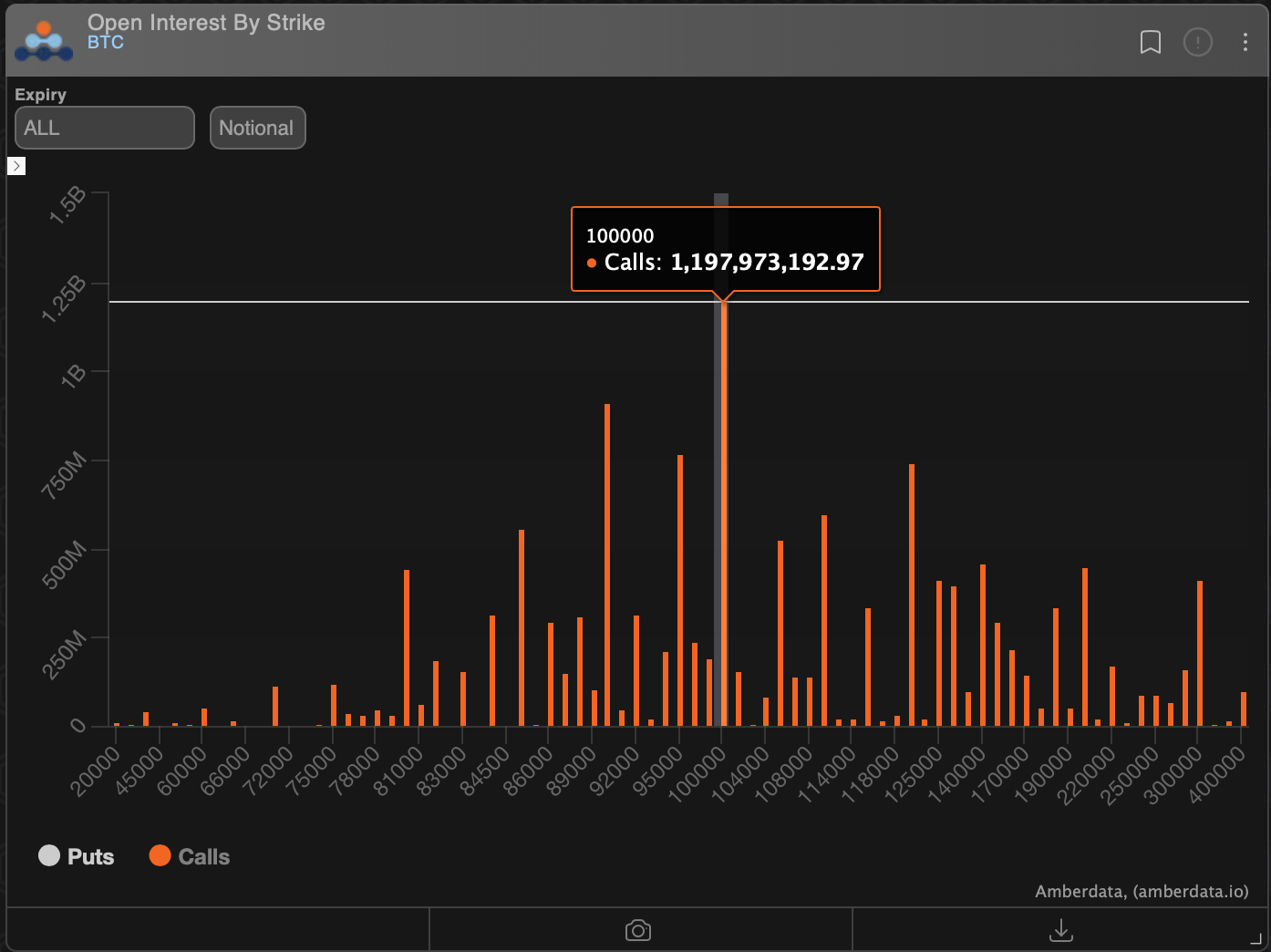

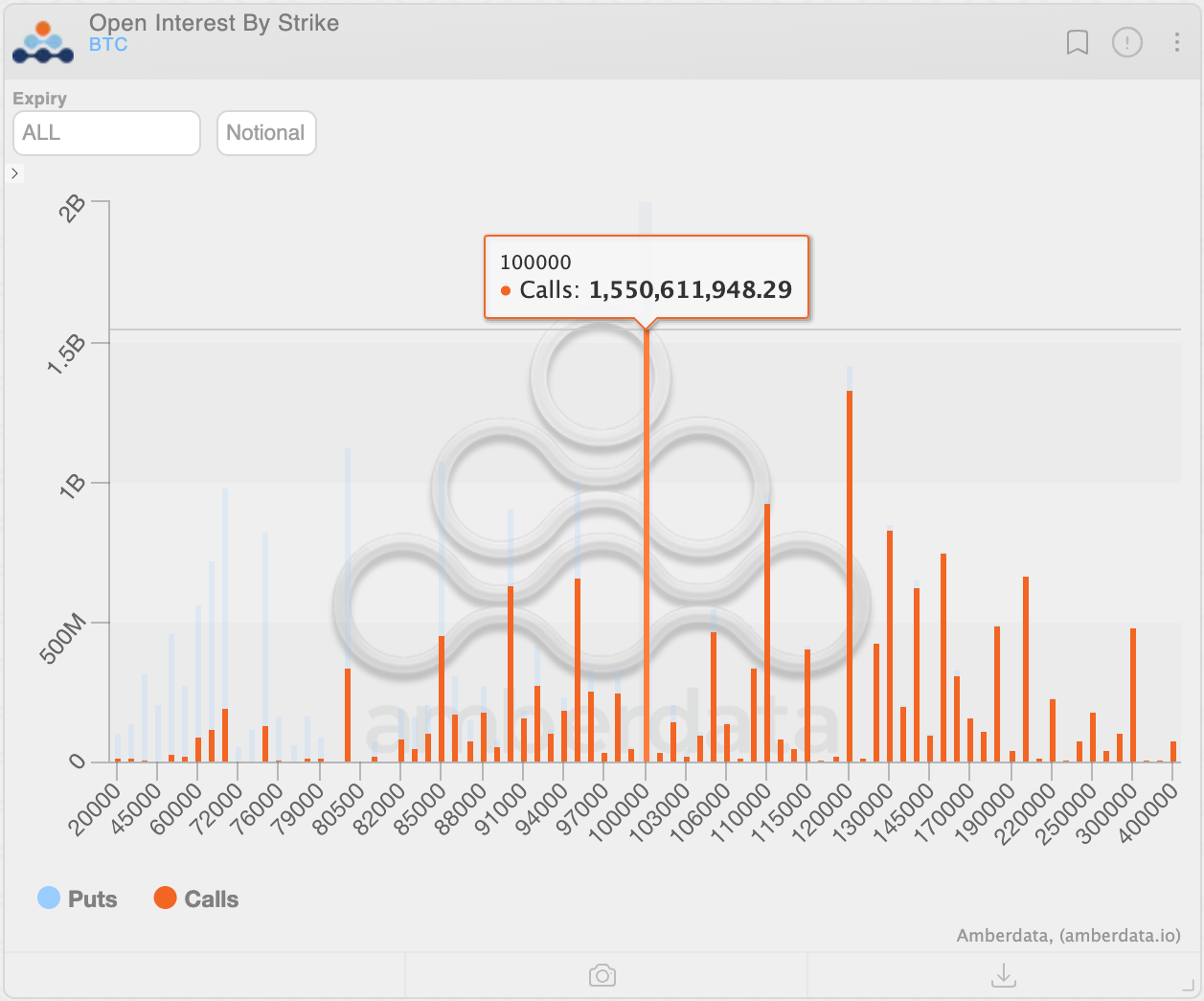

Bitcoin Options Play Shows $100K Target Back in Bulls’ Crosshair

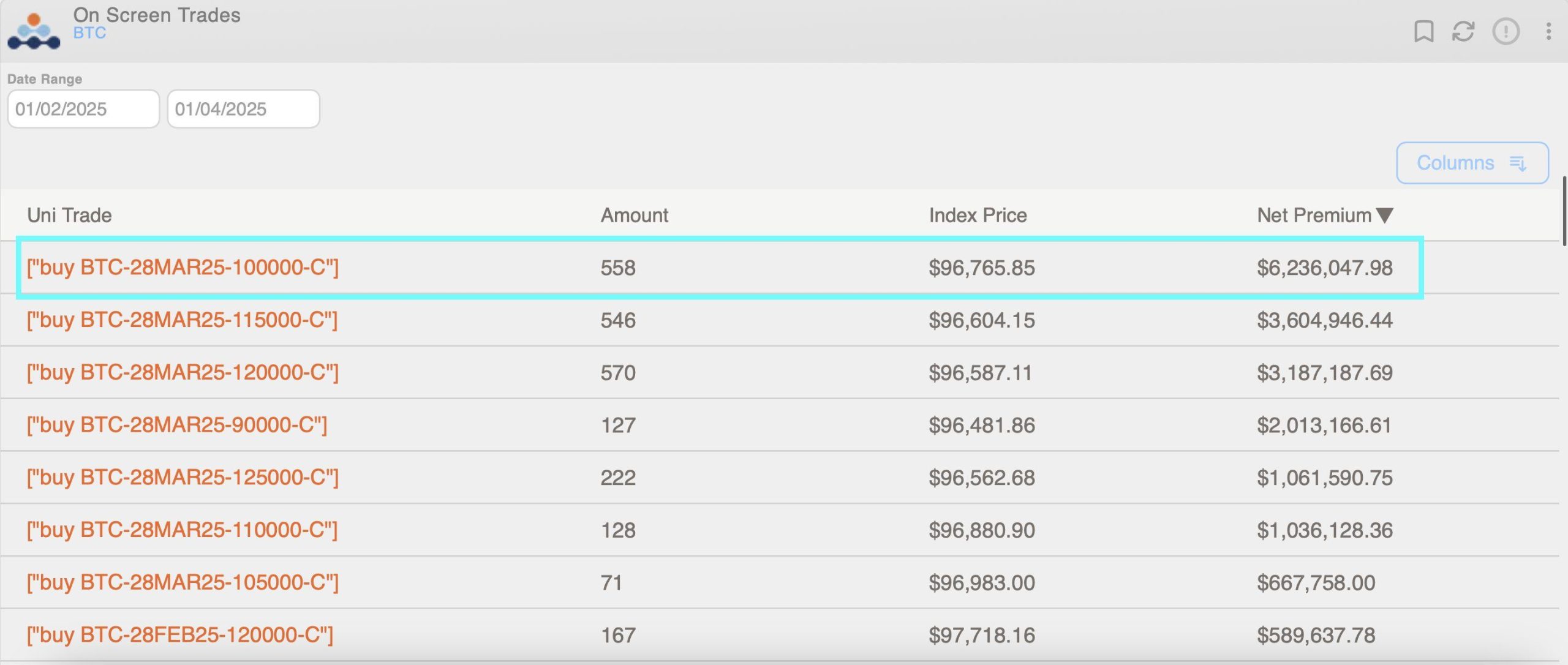

Bullish bitcoin (BTC) options strategies are becoming popular again, stabilizing a crucial sentiment indicator that indicated panic early last week. BTC has bounced to over $84,000 since probing lows...