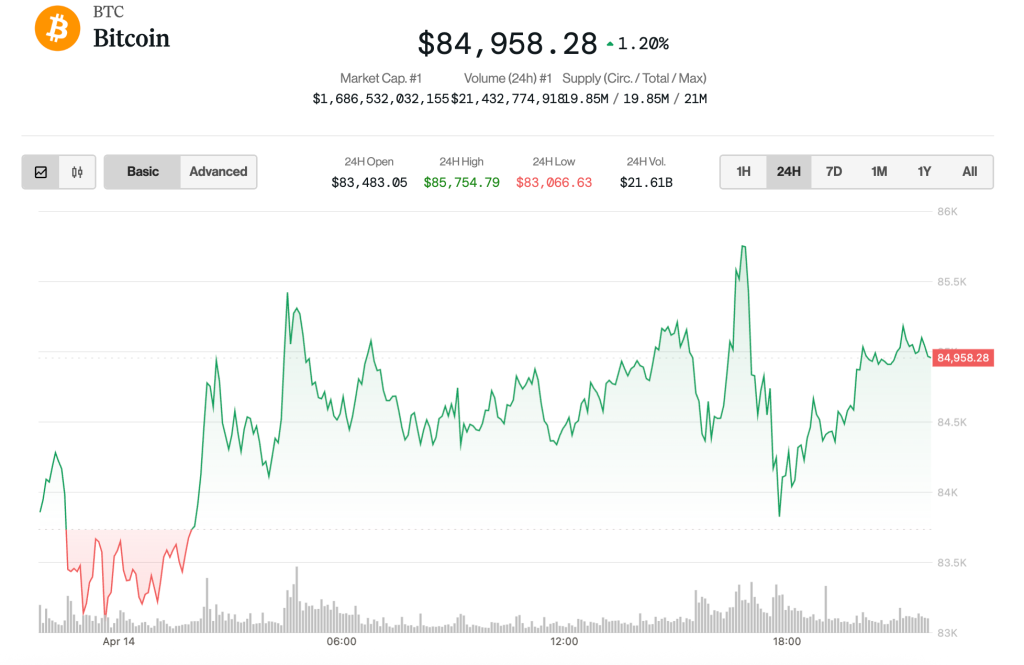

SOL Jumps 6%, Bitcoin Clings to $84K on Dampened Rate Cut Hopes

Crypto markets steadily rose in Asian morning hours Thursday after a sell-off the night before as Fed chair Jerome Powell dashed hopes of early rate cuts as küresel markets gerçek from the impact of newly-levied U.S. tariffs. Bitcoin (BTC) added 2% in …