Crypto Whale Shorts $445M in Bitcoin While Taking Bullish Bet on MELANIA Token, Hyperliquid Data Show

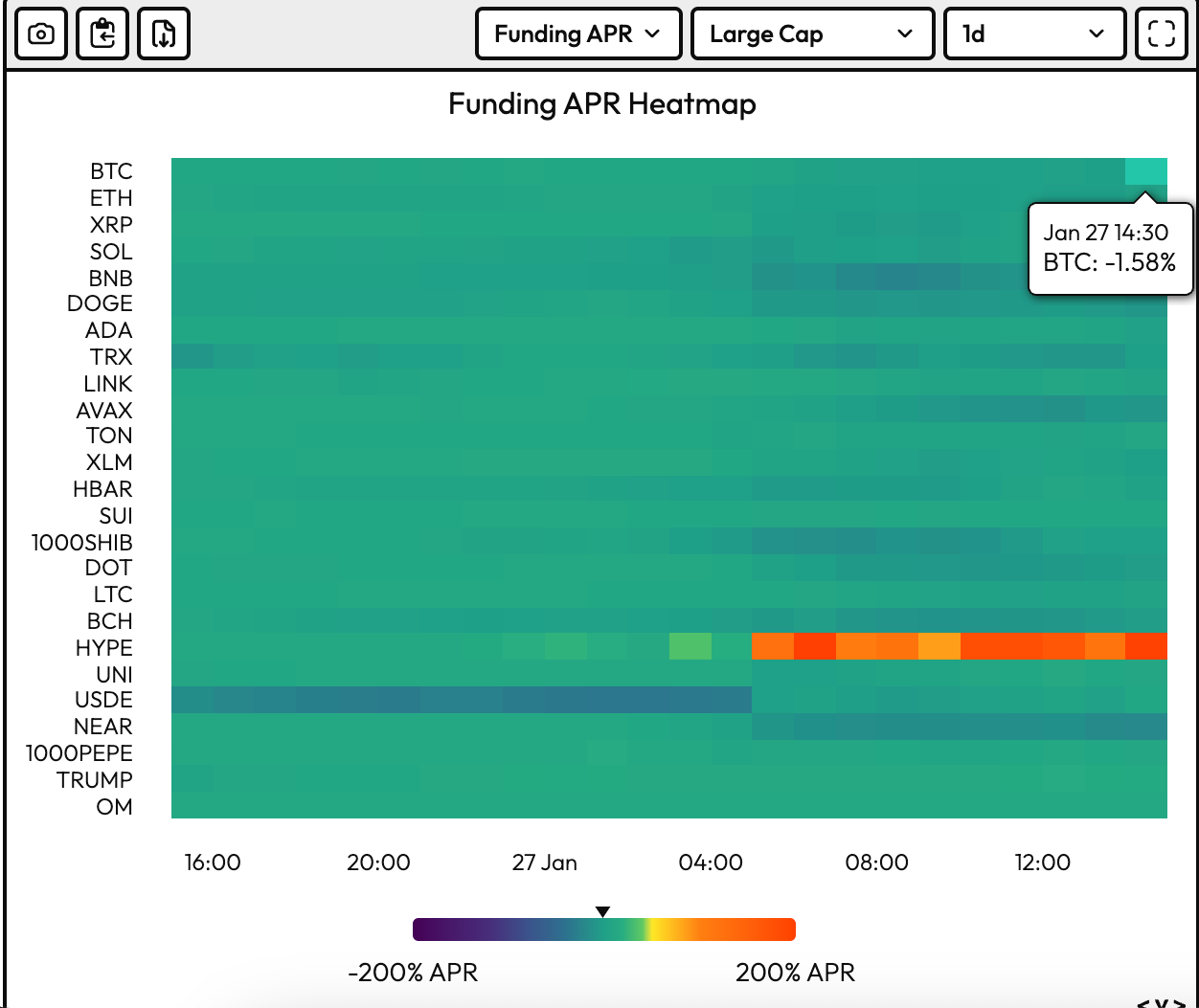

Bitcoin (BTC) has steadied since last Tuesday, bouncing to its 200-day average above $84,000 over the weekend. Still, a crypto whale has taken a contrarian stance by raising a...